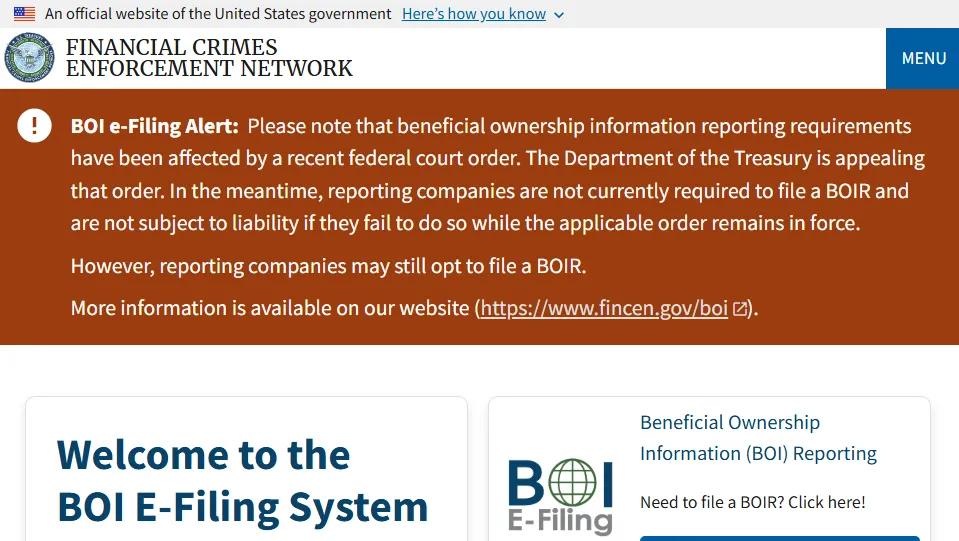

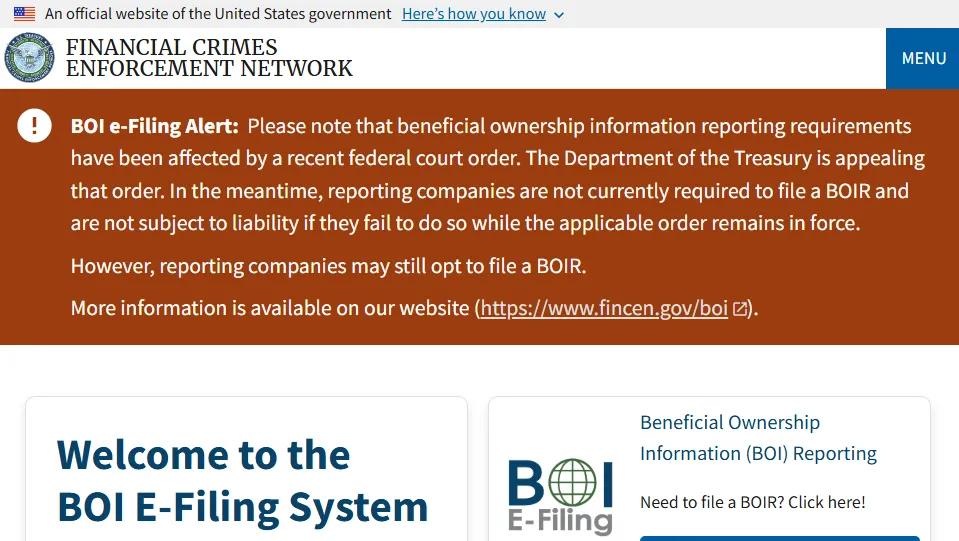

The U.S. District Court for the District of Texas has issued a nationwide preliminary injunction barring the enforcement of the beneficial ownership reporting requirements (BOI Reporting) mandated by the Corporate Transparency Act (CTA). (See Texas Top Cop Shop v. Garland (December 3, 2024), U.S. District Court for the Eastern District of Texas, Case No. 4:24-CV-478.) According to the Texas court’s ruling, Congress exceeded its authority when enacting the CTA, which constitutes an unconstitutional infringement on the states’ right to regulate businesses. The court has issued a nationwide injunction applicable to all reporting companies, prohibiting FinCEN from enforcing the January 1, 2025 reporting deadline.

The U.S. District Court for the District of Texas has issued a nationwide preliminary injunction barring the enforcement of the beneficial ownership reporting requirements (BOI Reporting) mandated by the Corporate Transparency Act (CTA). (See Texas Top Cop Shop v. Garland (December 3, 2024), U.S. District Court for the Eastern District of Texas, Case No. 4:24-CV-478.) According to the Texas court’s ruling, Congress exceeded its authority when enacting the CTA, which constitutes an unconstitutional infringement on the states’ right to regulate businesses. The court has issued a nationwide injunction applicable to all reporting companies, prohibiting FinCEN from enforcing the January 1, 2025 reporting deadline.

The Corporate Transparency Act (CTA) originally required all U.S. companies to submit Beneficial Ownership Information (BOI) filings. Its purpose was to combat financial crimes such as money laundering and illegal financing, and to ensure corporate transparency. However, due to opposition from some companies and institutions, nearly one year after the CTA took effect, a Texas court issued a preliminary injunction to suspend the enforcement of this filing requirement. Courts in several other states and jurisdictions, however, still uphold the U.S. Department of the Treasury’s position. Currently, the U.S. Department of the Treasury has appealed the Texas court’s ruling. As a result, the filing requirements may still change at any time. If the Treasury succeeds in its appeal, the mandatory BOI filing requirement will be reinstated promptly. We will continue to follow up on developments and provide you with the latest updates.

Our Company’s Recommendations:

1. Unless there are special circumstances, we recommend arranging voluntary compliance filings. This is to prevent penalties resulting from late filings—should the appeal succeed and BOI reporting requirements be reinstated, clients may miss updates on policy changes and fail to file on time.

2. Given that this policy is currently in litigation and the situation may update or change at any time, we recommend closely monitoring the latest announcements from the U.S. Department of the Treasury and FinCEN in a timely manner.

*The content above is not original. Relevant regulations and explanations are summarized and translated from materials collected on official government websites and reliable third-party platforms, followed by resource integration and re-editing. All copyrights belong to the original authors. This article is for information sharing only and not for commercial use.

+1 949-490-9063

+1 949-490-9063 10 CORPORATE PARK, STE 330, IRVINE, CA 92606

10 CORPORATE PARK, STE 330, IRVINE, CA 92606