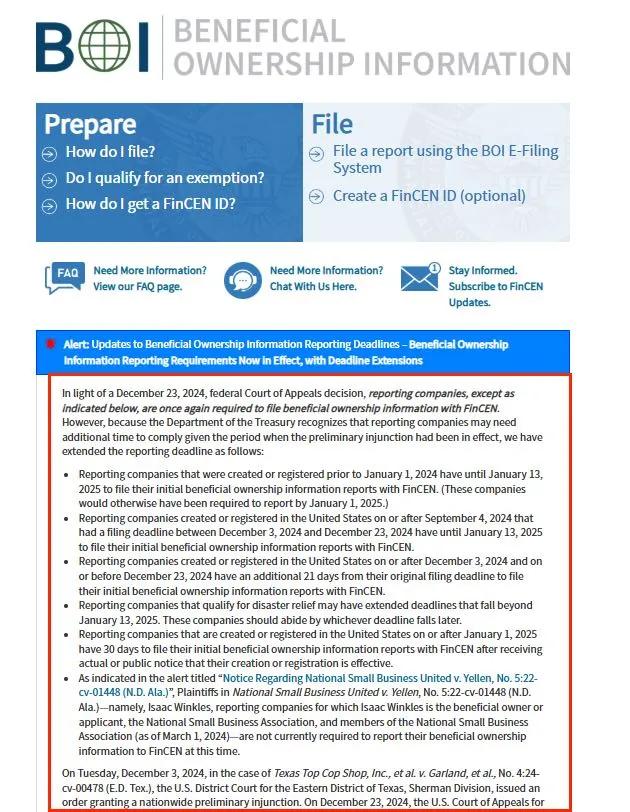

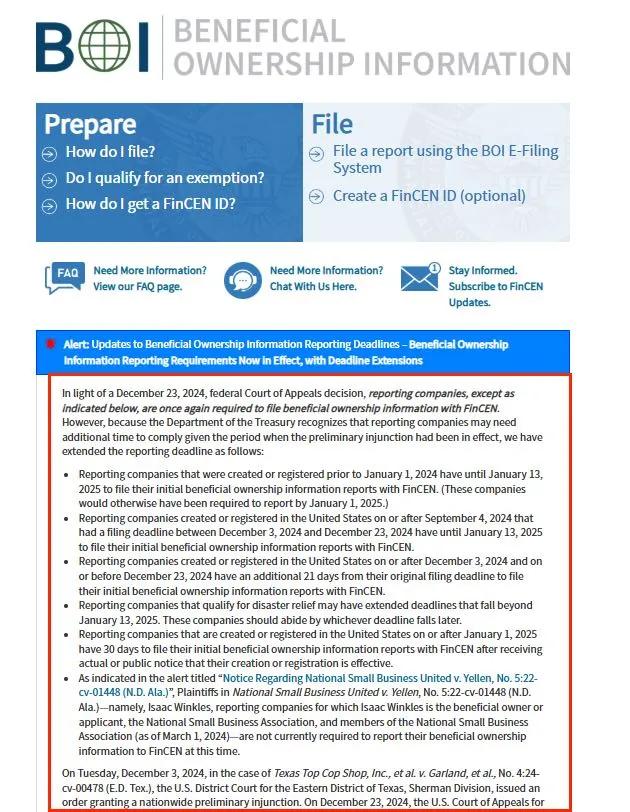

On December 23, 2024, according to the latest official information, the U.S. Federal Court of Appeals overturned the December 3 ruling that had halted Beneficial Ownership Information (BOI) filings. The preliminary nationwide injunction has now been lifted, and mandatory BOI submissions have been reinstated. The Financial Crimes Enforcement Network (FinCEN) announced an extension of the filing deadline; the general deadline is now January 13, 2025 (instead of January 1).

Specifically, FinCEN stated that because the U.S. Department of the Treasury "recognizes that reporting companies may need additional time to comply, given the period during which the preliminary injunction was in effect," the current filing deadlines have been extended as follows:

Reporting companies created or registered before January 1, 2024 must submit their initial BOI reports to FinCEN by January 13, 2025. (Previously, these companies would have been required to report by January 1, 2025.)

Reporting companies created or registered in the U.S. on or after September 4, 2024, whose original filing deadlines fell between December 3, 2024, and December 23, 2024, must submit their initial BOI reports to FinCEN by January 13, 2025.

Reporting companies created or registered in the U.S. on or after December 3, 2024, and on or before December 23, 2024 will have 21 additional days from their original filing deadline to submit their initial BOI reports to FinCEN.

Reporting companies eligible for disaster relief may have their deadlines extended beyond January 13, 2025. These companies should adhere to any applicable extended deadlines.

Reporting companies created or registered in the U.S. on or after January 1, 2025 will have 30 days from the date they receive actual or public notice that their creation or registration is effective to submit their initial BOI reports to FinCEN.

The case remains ongoing in litigation. However, the U.S. Court of Appeals for the Fifth Circuit stated in its order that "the government has strongly shown that it is likely to succeed in defending the constitutionality of the Corporate Transparency Act (CTA)."

Based on feedback regarding the latest current situation, reporting requirements may still change at any time in the short term. At this stage, clients subject to mandatory BOI reporting requirements should arrange for accountants to assist with compliance and complete BOI filings by January 13, 2025. They should avoid taking chances, as this could lead to penalty risks. We will continue to follow up on developments and provide you with the latest updates.

*The content above is not original. Relevant regulations and explanations are summarized and translated from materials collected on official government websites and reliable third-party platforms, followed by resource integration and re-editing. All copyrights belong to the original authors. This article is for information sharing only and not for commercial use.

+1 949-490-9063

+1 949-490-9063 10 CORPORATE PARK, STE 330, IRVINE, CA 92606

10 CORPORATE PARK, STE 330, IRVINE, CA 92606