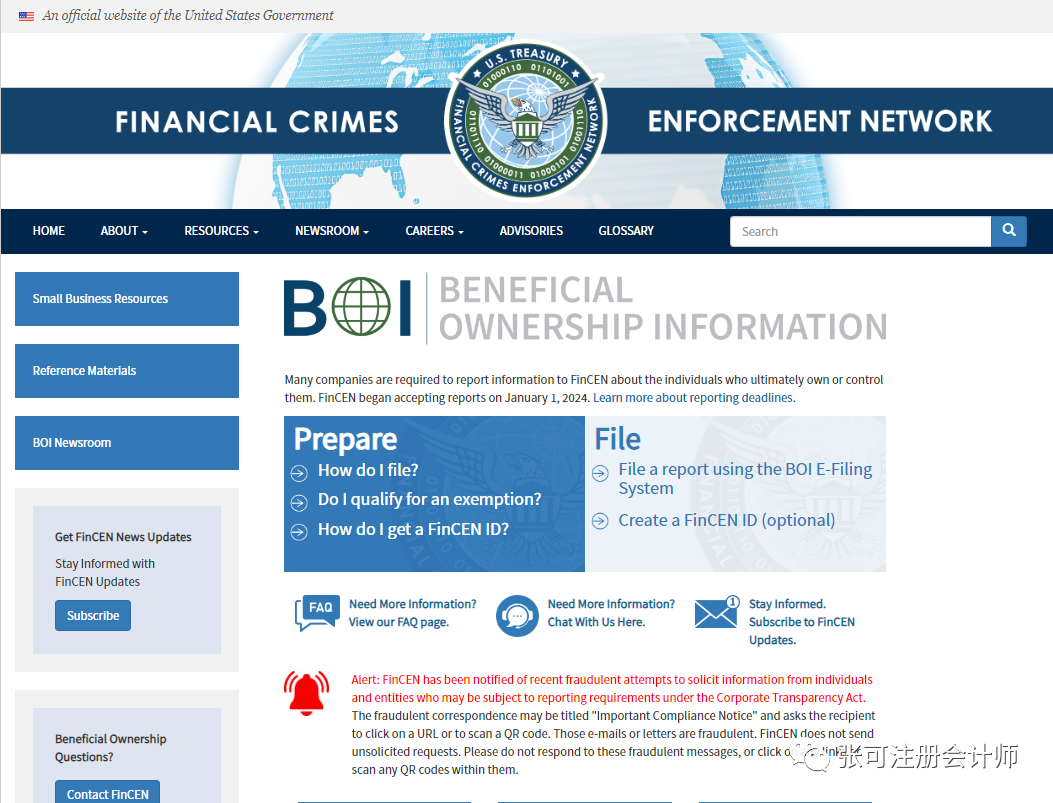

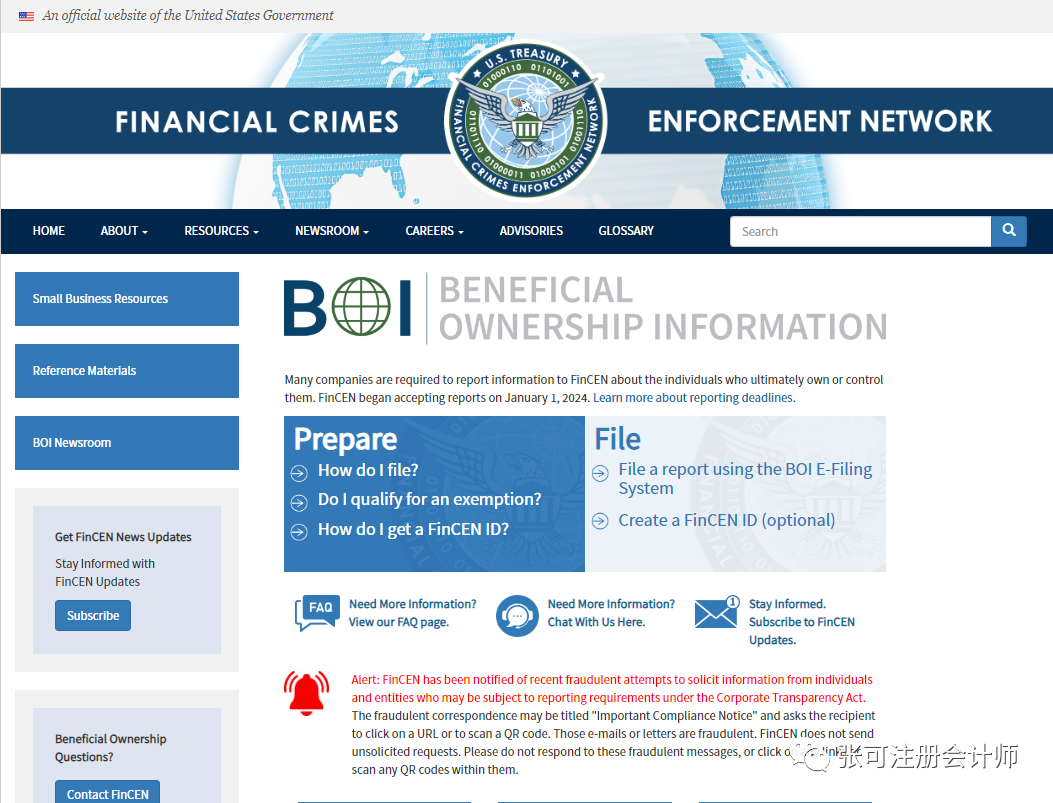

The Financial Crimes Enforcement Network of the U.S. Department of the Treasury (referred to as FinCEN for short; hereinafter, we will use "FinCEN" to denote this agency).

An increasing number of illegal financial activities in the United States have harmed the interests of legitimate businesses and ordinary citizens. In response, Congress passed the Corporate Transparency Act. This Act requires all companies formed and operating in the United States to report their Beneficial Ownership Information (referred to as BOI for short) to FinCEN.

The U.S. Corporate Transparency Act (CTA) will take effect on January 1, 2024. After the Act takes effect, eligible companies registered in the United States must submit a BOI Report to FinCEN, with the following deadlines:

For companies registered between January 1, 2024, and January 1, 2025: They must report their direct and indirect shareholders to FinCEN within 90 days of registration.

For companies registered before 2024: They must report their direct and indirect shareholders to FinCEN by January 1, 2025.

For companies registered after 2025: They must report their direct and indirect shareholders to FinCEN within 30 days of registration.

一、Is my company a "Reporting Company"?

The reporting rules require all "Reporting Companies" to submit a BOI Report to FinCEN within the aforementioned specific timeframes. A Reporting Company refers to any entity that meets the definition of a "Reporting Company" and does not qualify for an exemption. Reporting Companies are divided into two categories: "Domestic Reporting Companies" and "Foreign Reporting Companies." If your company is neither a "Domestic Reporting Company" nor a "Foreign Reporting Company—either because it fails to meet the criteria for either definition (as outlined below) or is eligible for an exemption—it is not required to submit a BOI Report to FinCEN.

The following chart illustrates how to determine whether your company qualifies as a "Reporting Company":

二、Is my company exempt from the reporting requirement?

The reporting rules exempt twenty-three (23) specific types of entities from the reporting requirement. Entities that meet these exemption criteria are not required to submit a BOI Report to FinCEN.

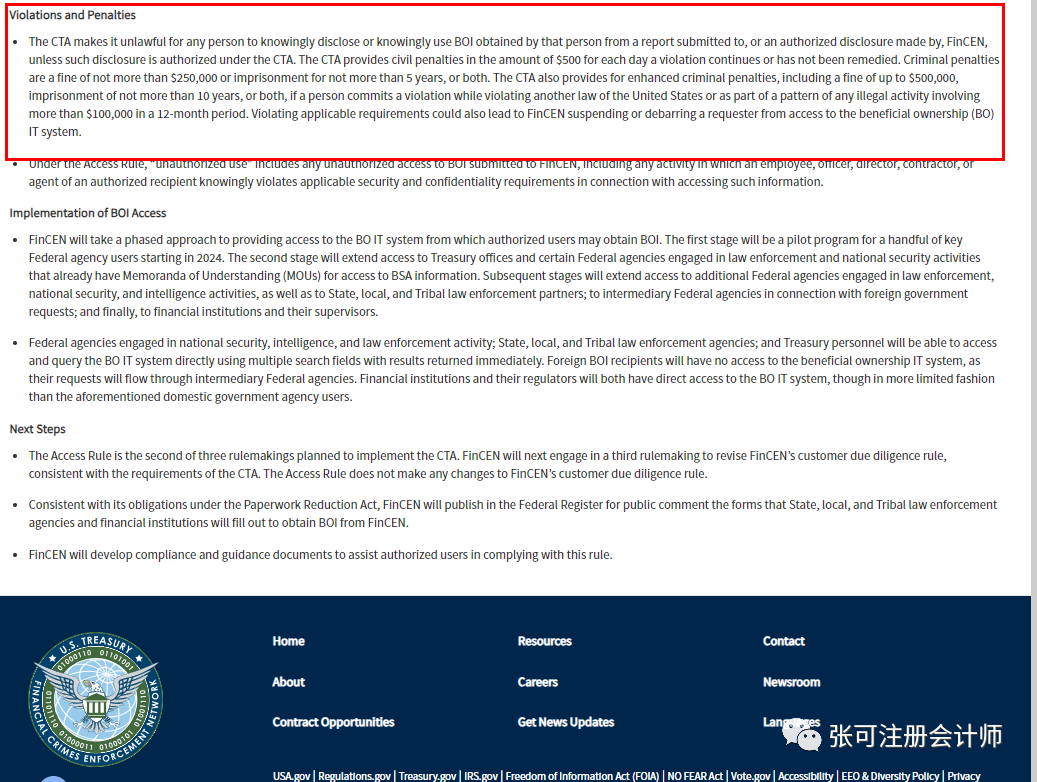

三、What happens if my company fails to report BOI within the specified timeframe?

FinCEN is issuing this guidance, along with other instructional materials, and conducting outreach activities to ensure all Reporting Companies understand their reporting obligations—including the obligation to update or correct beneficial ownership information. If a person has reason to believe that a report submitted to FinCEN contains inaccurate information and voluntarily files an amended report to correct such information within 90 days after the original report’s deadline, they will be exempt from penalties under the Corporate Transparency Act. However, if a person intentionally fails to report complete or updated beneficial ownership information to FinCEN, or intentionally provides or attempts to provide false or fraudulent beneficial ownership information, FinCEN will determine an appropriate enforcement response based on the enforcement factors it has issued.

Intentionally failing to report complete or updated beneficial ownership information to FinCEN, or intentionally providing or attempting to provide false or fraudulent beneficial ownership information, may result in civil or criminal penalties. These include a civil penalty of up to $500 per day for each day the violation continues, or criminal penalties such as imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity that fails to file the required BOI Report may be held liable for such failure.

Providing false or fraudulent beneficial ownership information may include supplying false identification information for individuals specified in the BOI Report—for example, providing a copy of a fake identification document.

Additionally, any person who intentionally causes a company to fail to file the required BOI Report or to report incomplete or false beneficial ownership information to FinCEN may be subject to civil and/or criminal penalties.

For instance, an individual who qualifies as a beneficial owner or company applicant may refuse to provide information, knowing that without such information, the company will be unable to submit complete beneficial ownership information to FinCEN. Furthermore, an individual may provide false information to the company, knowing that such information will be reported to FinCEN.

四、Is annual filing required?

No, a company is only required to file once. If there are subsequent updates to the information of the company’s beneficial owners (shareholders), the changes must be modified and reported to FinCEN within 30 days.

In simple terms, if there is a change in shareholders who hold more than 25% of the company’s ownership, the relevant information must be updated to FinCEN within 30 days.

五、What Is Substantial Control?

Reporting Companies must identify all individuals who exercise substantial control over the company. There is no upper limit on the number of individuals who exercise substantial control. An individual exercises substantial control over a Reporting Company if they meet any of the following four general criteria: (1) the individual is a senior officer; (2) the individual has the authority to appoint or remove certain management personnel or a majority of the directors of the Reporting Company; (3) the individual is a key decision-maker; or (4) the individual exercises substantial control over the Reporting Company in other ways. For detailed information on these criteria, please refer to the table below.六、Information Required for Filing

① The company’s name, U.S. company address, EIN (Employer Identification Number), the U.S. state where the company is registered, and a complete set of company registration documents.

② For all shareholders who own more than 25% of the company, and individuals who have significant influence over the company’s major decision-making: their full names, dates of birth, current personal addresses, personal SSN (Social Security Number) (not required if unavailable), passport numbers, and a copy or clear photo of a valid passport.

七、Processing Time Required for Filing

Processing Time for Completion of Filing: 3-5 business days八、Summary

Failure to file on time or filing falsely in violation of regulations shall be subject to the following penalties:

1. A fine of 500 US dollars per day.

2. A fine of 10,000 US dollars for individuals or imprisonment for a maximum term of two years.

Some people hold the misconception that they don’t need to file just because they are not in the United States.

However, if you need to enter the United States, apply for a US visa, or already hold a valid US visa in the future, the Financial Crimes Enforcement Network (FinCEN) may disclose your violation to the relevant parties it deems appropriate, exposing you to potential legal risks.

Additionally, if your company is sued due to various issues, FinCEN may impose penalties on you and even exercise long - arm jurisdiction over you individually. When you enter countries with ties to the United States, it is also possible that you will be restricted and extradited in accordance with the aforementioned provisions.

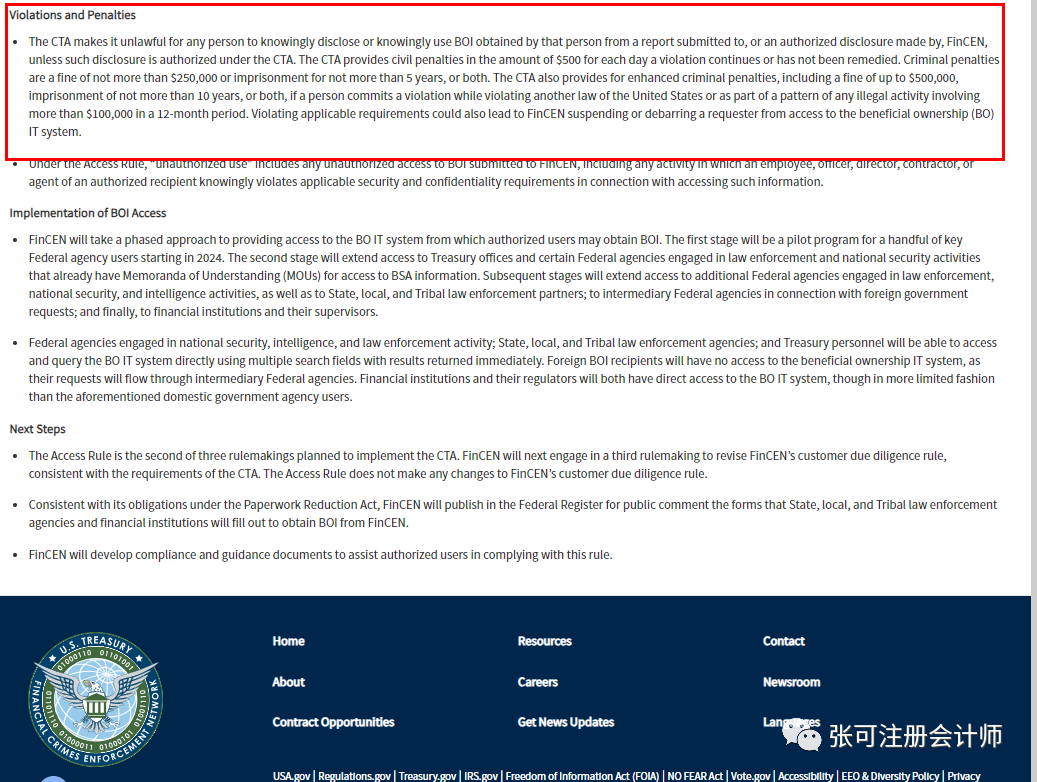

The following is an excerpt from the original provisions on the BOI report and the explanations of fines for late filing on FinCEN’s official website:

*The content and images of the above article are not original. Relevant regulations and explanations have been collected from public websites of various government agencies and reliable sources, followed by summarization, translation, resource integration and re-editing.

*The content and images of the above article are not original. Relevant regulations and explanations have been collected from public websites of various government agencies and reliable sources, followed by summarization, translation, resource integration and re-editing.

+1 949-490-9063

+1 949-490-9063 10 CORPORATE PARK, STE 330, IRVINE, CA 92606

10 CORPORATE PARK, STE 330, IRVINE, CA 92606