一、What is Form 1099-K?

Form 1099-K is an information return filed with the Internal Revenue Service (IRS) by payment card companies and third-party network transaction platforms. It is used to report to the IRS the "total reportable transaction amount" of payment card and third-party network transaction platforms during a given calendar year.

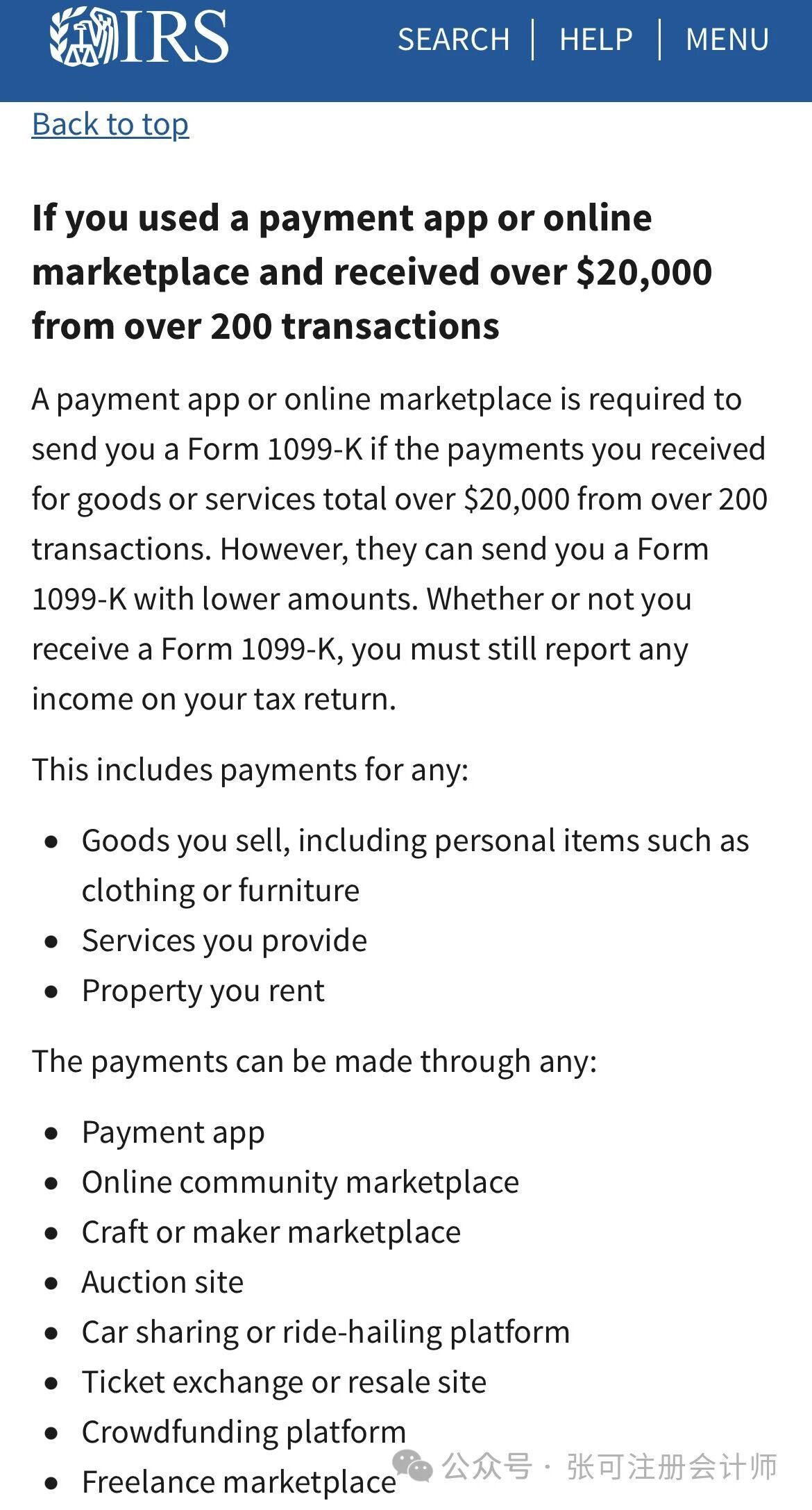

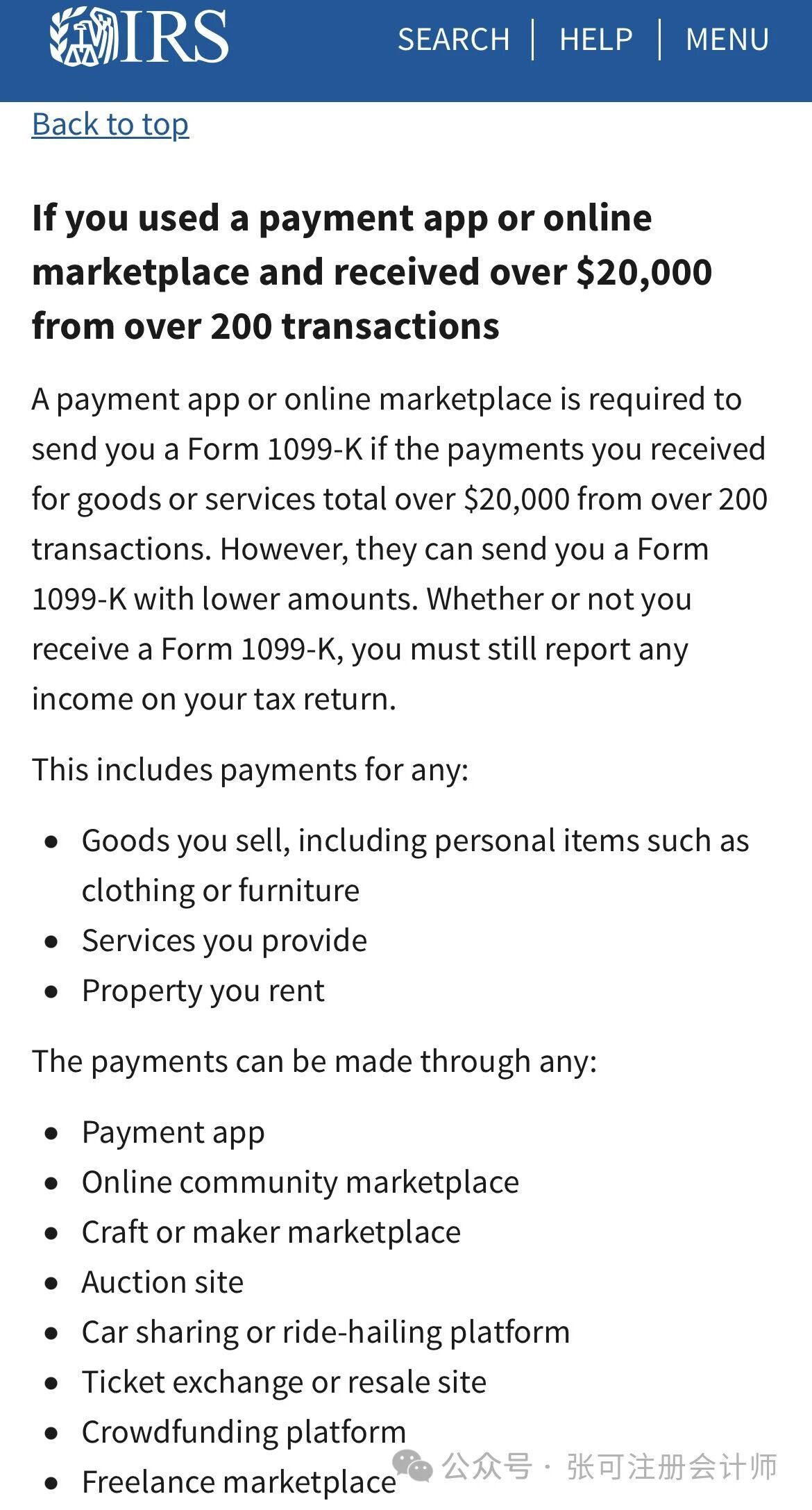

If you accept electronic payments for selling goods or providing services, and your income exceeds $600 within a calendar year (per the IRS policy update in November 2023, Form 1099-K will be issued to taxpayers who received over $20,000 from more than 200 transactions in 2023), you may receive Form 1099-K. When filing annual compliant income tax returns, all income must be reported on your tax return.

二、What is the total reportable transaction amount?The 'total transaction amount' refers to the total U.S. dollar amount of reportable transactions for the payee, without regard to any adjustments for credits, cash equivalents, discount amounts, fees, refund amounts, or any other amounts. The U.S. dollar amount of each transaction is determined as of the date of the transaction."三、Who receives Form 1099-K?

Every payment settlement entity or transaction platform that transfers funds to a payee’s account must, after settling the transaction amount paid to the payee in the settlement year, file an information return (Form 1099-K) for each payee in that calendar year both to the payee and the Internal Revenue Service (IRS).

For cross-border e-commerce clients, the current tax filing targets of transaction platforms and payment settlement entities mainly include small business owners who use third-party payment platforms for receiving and making payments (such as third-party payment platform companies, Square, Venmo, PayPal, etc.), as well as sellers who sell through third-party e-commerce platforms (Etsy, Walmart, eBay, Amazon, TikTok, etc.).

If you received transaction payments that meet the threshold in the previous calendar year, you should receive Form 1099-K by January 31. This form includes amounts from all payment card transactions (e.g., debit cards, credit cards, or stored-value cards) and third-party payment network transactions that exceed the reporting threshold.

四、IRS Update on Form 1099-K Transaction Threshold Policy

In November 2023, the Internal Revenue Service (IRS) decided to delay the implementation of the new $600 threshold requirement for third-party payment organizations for the 2023 tax year.

Payment apps and online marketplaces are only required to send Form 1099-K to taxpayers who received more than $20,000 from over 200 transactions in 2023.

According to an IRS announcement, by 2024, the threshold for Form 1099-K will be lowered to $5,000.

五、What Should Taxpayers Do When They Receive Form 1099-K?

If you receive Form 1099-K, it typically includes the total amount of all reportable payment transactions from payment institutions. Once you have collected all your business income—including the income reported on Form 1099-K—you will use this information to complete Form 1120, Form 1120-S, or Form 1065.

When a taxpayer receives Form 1099-K, they should first verify the following information:

(1) Whether Form 1099-K belongs to them or is a duplicate.

(2) The filer/payee information and Taxpayer Identification Number (TIN).

(3) The total amount of payment card/third-party network transactions.

(4) The number of payment transactions.

(5) Whether the Merchant Category Code (MCC) accurately describes your business.

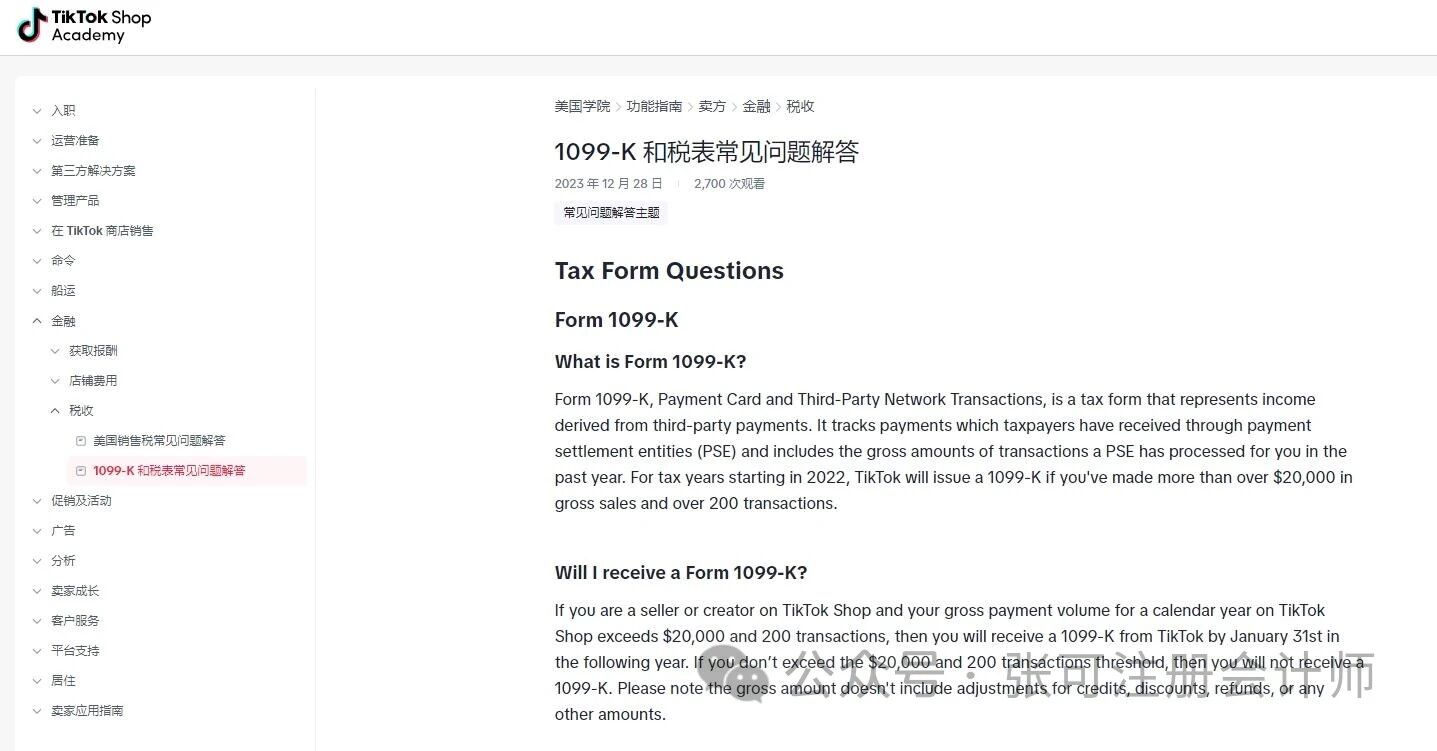

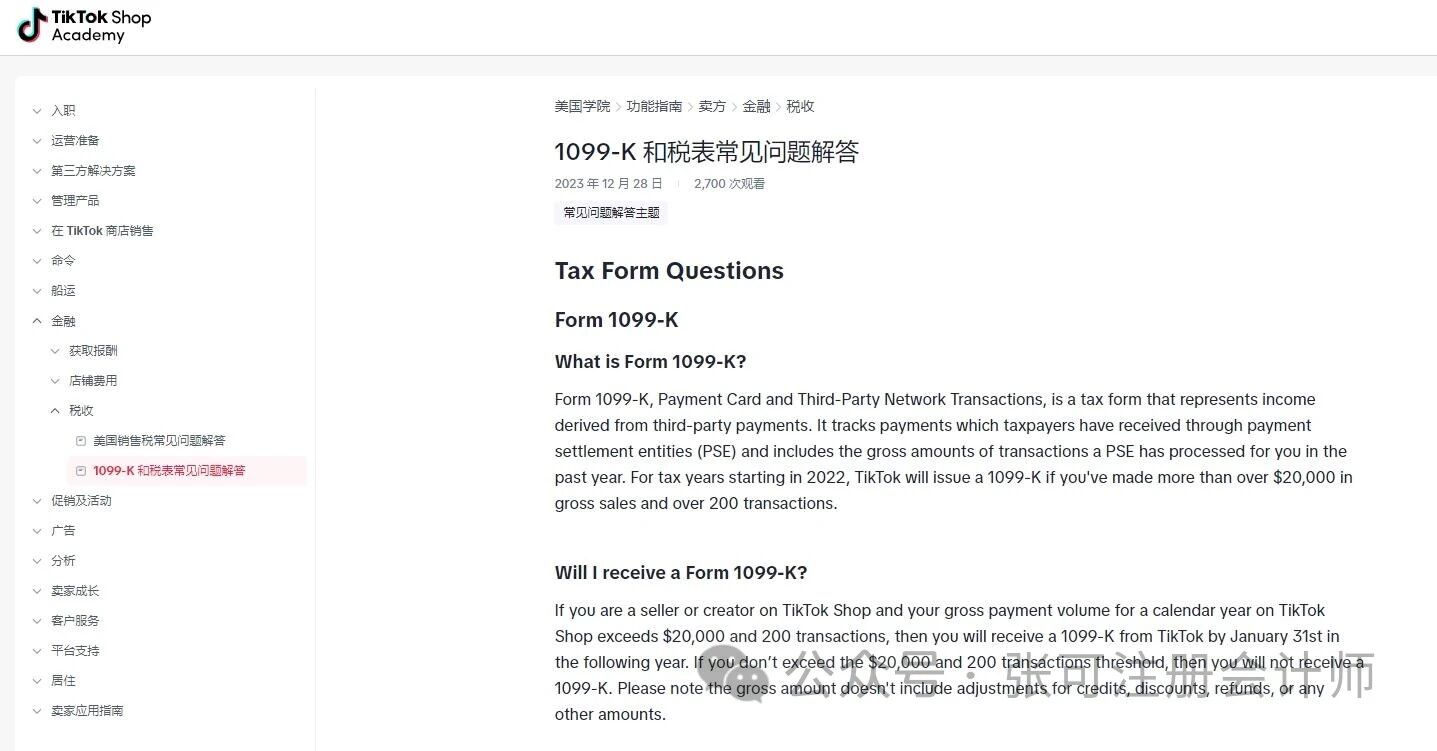

六、Recent Tax Policies for TikTok's U.S. Region

On December 28, 2023, TikTok U.S. officially rolled out a policy. For stores with sales exceeding $20,000 and 200 transactions, tax information will be issued by January 31, 2024. If the tax information is incorrect or no tax is paid as required, 24% of the total amount (excluding points, discounts, refunds, or any other adjustments to the amount) will be compulsorily withheld.

1. Withholding Method: The amount will be temporarily withheld in the form of reserve funds.

2. Triggering Scenarios:

1. The tax information provided during store registration is incorrect;

2. No compliant tax declaration and payment are made after receiving Form 1099-K.

One of the pieces of information to be filled in when registering a TikTok U.S. Store is the actual address, and there are two possible scenarios regarding this address. First, the address is correct and enables successful receipt of correspondence. Second, the address is incorrect, resulting in failure to receive any mail. If the store is registered with false documentation, the legal representative will not file tax returns, which is what we refer to as a "tax compliance breach". An incorrect address will lead to no one handling the tax matters of the TikTok Store, and the temporary withholding will then become permanent. Furthermore, the tax information for TikTok U.S. Stores must be provided by completing Form W-9

1. How do I provide my tax information?

Your tax information shall be provided by filling out Form W - 9. To complete this form, please navigate to "Checkout - Tax" in the TikTok Shop Seller Center. Following the guidance on the page, you can input and electronically authenticate your sales tax information there.

2. What is Form W - 9?

Form W - 9 is an official form issued by the Internal Revenue Service (IRS) for employers or other entities. It is used to verify the name, address, and Taxpayer Identification Number (TIN) of individuals who receive income. The information obtained from Form W - 9 is generally used to generate 1099 tax forms, which are required for income tax filing.

3. Tax Compliance for TikTok in the United States

Since the official update was released on December 28, 2023, it currently appears that only in December will 24% of the amount be temporarily withheld in the form of reserve funds. By extension, if your tax information is accurate and you pay taxes as required, the temporarily withheld funds will be refunded to you. This highlights the significance of legally held and fully tax - compliant stores. All other funds will be disbursed to you normally.

Previously, TikTok announced its goal of expanding the scale of its e - commerce business in the United States tenfold to 17.5 billion US dollars, and this initiative may be adjusted according to the development of the business. Given the rapid growth of TikTok in the US market, sellers who intend to enter or have already launched their businesses on TikTok in the US must also operate in compliance with relevant regulations to avoid the impacts caused by non - compliance

七、Tax Compliance for U.S. Businesses

For e-commerce sellers registered on platforms such as Amazon and Walmart, tax filing is particularly crucial. In recent years, many Chinese sellers have established companies in the United States to leverage the advantages of local registration. However, due to the lack of overseas operation teams and understanding of U.S. tax compliance among some sellers in the early stages, these companies face numerous risks in annual inspections and tax filing—often resulting from issues like underreporting of income. As U.S. publicly traded e-commerce platforms, they have successively rolled out various tax compliance policies, aiming to require merchants in the U.S. to truthfully and compliantly file tax returns in line with IRS requirements. During audits, non-compliant stores (those failing to meet tax compliance standards) may be shut down each year.

The fiscal year of U.S. businesses typically follows the calendar year (ending on December 31). Taxpayers must generally file their tax returns by the 15th day of the fourth month after the end of the fiscal year (i.e., April 15). Additionally, U.S. businesses are required to complete annual state-level inspections on time. Starting from the first year after registration, they must pay franchise taxes and state-level annual maintenance fees in accordance with the requirements of each state. Failure to pay maintenance fees on time may affect the company’s normal operating status and lead to other serious consequences.

While the IRS typically only conducts random audits on 1% to 3% of taxpayers, being selected for an audit can result in severe legal penalties under U.S. law, as well as potential debt accumulation and a decline in credit scores.

Damage to U.S. Company Credit

If a U.S. company files tax returns or pays taxes late, it will leave a negative credit record with the IRS. This not only harms the company’s standing but also damages the credit scores of its directors and shareholders.

Receiving a Court Summons

The worst-case scenario occurs when a U.S. company fails to file tax returns, pay taxes, or cooperate with the IRS—in such cases, the company will receive a court summons.

Amid increasingly stringent U.S. tax regulations, if platform sellers have registered a U.S. company and operate compliantly in the U.S., it is advisable to adhere to U.S. tax laws, file returns compliantly, and engage U.S.-licensed certified public accountants (CPAs) or tax professionals to handle accounting and tax filing. This ensures the compliance and completeness of tax and financial declarations.

*The content and images of the above article are not original. Relevant regulations and explanations are summarized and translated from public websites of various governments and reliable sources, followed by resource integration and re-editing. All copyrights belong to the original authors. This article is for information sharing only and not for commercial use.

The sources of the article content are not limited to:

https://www.irs.gov/businesses/understanding-your-form-1099-k

https://m.mjzj.com/article/1744544508512833536

https://www.cnsdgy.com/983.html

+1 949-490-9063

+1 949-490-9063 10 CORPORATE PARK, STE 330, IRVINE, CA 92606

10 CORPORATE PARK, STE 330, IRVINE, CA 92606